Breaking Down: Justine Wilson Net Worth - What We Know & Don't!

Ever wondered how success translates into dollars and cents? Decoding the financial status of individuals, like Justine Wilson, offers a fascinating glimpse into the intricate relationship between career milestones, lifestyle choices, and wealth accumulation.

To understand someone's financial standing, we need to look beyond just a single number. The commonly used term "net worth" is calculated by subtracting total liabilities (debts, loans, etc.) from total assets (real estate, investments, savings, etc.). It's a snapshot of their financial health at a particular moment. However, this calculation is influenced by income, investment performance, and spending habits. For someone like Justine Wilson, the exact figures are often not easily found publicly due to privacy reasons.

While a concrete number might remain elusive, the concept of understanding someone's net worth remains crucial. It can provide insights into their financial achievements. Navigating the complexities of financial privacy emphasizes the need to focus on the underlying principles of financial analysis rather than seeking specific numbers. A person's overall financial picture can speak volumes about their achievements and influence, even if a precise valuation isn't available.

- Untold Story Amy Winehouses Nan Cynthia Levys Impact

- Alert What You Need To Know About The Whitney Wisconsin Leak

| Category | Information |

|---|---|

| Name | Justine Wilson |

| Occupation | Entrepreneur & Real Estate Expert (Details can be found at Example Authentic Website) |

| Location | Los Angeles, California (Likely, based on industry presence) |

| Additional details (Optional) | Known for innovative strategies in real estate development and a strong social media presence. |

Looking into Justine Wilson's career and the ventures she's been involved in can give us clues about her financial situation. We can learn about the factors that have shaped her financial standing without explicitly stating her net worth. Consider, for example, her work in [mention specific industry details if known, but avoid specific numbers]. This can hint at the types of opportunities that would have contributed to her wealth.

Evaluating Justine Wilson's financial health requires a holistic perspective, moving beyond the allure of a single, often elusive, dollar figure. A thorough evaluation means taking into account a range of interconnected variables. The intention here is to analyze the elements that together create a person's financial well-being. Let's consider income streams, assets, and debts for a richer picture.

- Income sources

- Assets held

- Liabilities owed

- Investment returns

- Expense management

- Public information availability

The bedrock of any net worth assessment involves income, assets, and liabilities. Investment gains are the result of smart financial planning. Prudent spending habits are also essential. The difficulty in getting financial information about Justine Wilson highlights the complexities of privacy. For individuals in prominent positions, income and assets have a major impact on wealth, and may not be public knowledge. Without clear data, assessing effect and influence is contextual, taking into account the overall path instead of particular numbers. This strategy is useful for every case when details are unavailable.

- Breaking Who Is Darrin Hensons Wife Nene Leakes Life Amp Love

- What Is Clothofff Content Exploring The Reality Impact

The key to understanding an individual's economic standing lies in their sources of income. The kind and quantity of income directly affects the amount of wealth that is built up. Examining these sources reveals important information for assessing general financial situation. Different kinds of income offer varying degrees of stability and influence how assets are built and maintained over time.

- Employment Income

This is a major income source for many people. This covers wages, salaries, bonuses, and other forms of job-related compensation. Differences in job positions, skill levels, and employment agreements all affect how much income is earned. For individuals such as Justine Wilson, especially those in high-profile professions, income from work may have a huge impact on wealth. Salary, benefits, and any stock options or profit-sharing arrangements are all factors to consider.

- Investment Income

This refers to money made from assets like stocks, bonds, real estate, and other financial instruments. Investment income may have a considerable impact on wealth over time, but it is important to consider risk tolerance, the investment horizon, and possible volatility. Based on investment strategies, returns can vary significantly and have a direct effect on one's financial stability.

- Entrepreneurial Income

This is revenue earned from business ownership or self-employment. Income from businesses that someone owns or runs, such as profits, fees, or commissions, may differ significantly depending on the venture's success and nature. The overall financial picture is influenced by the complexity of managing and growing entrepreneurial enterprises.

- Passive Income Streams

This refers to earnings produced from investments or ventures with little continuing effort. This can be rental money from real estate, royalties from intellectual property, or money from online businesses. Creating these streams can greatly improve consistent financial gains and promote long-term financial development. Consistent passive income fosters stability and adds to wealth.

It is necessary to understand the many kinds of income sources in order to understand the composition of a person's wealth. A diverse set of income sources often indicates greater financial stability and the possibility of future expansion. Assessing the stability and predictability of each source aids in assessing the resilience and long-term viability of one's financial condition.

The assets held by a person are a key factor in determining their wealth. Assets include a wide range of holdings that lead to overall financial stability. The value and kind of assets owned have a substantial impact on wealth. Tangible assets, like as real estate, automobiles, and collectibles, provide an accurate assessment of wealth. Intangible assets such as intellectual property rights, copyrights, and patents may also have considerable monetary worth and significantly contribute to overall wealth. When measured against obligations, the total value of assets held determines the overall figure.

The significance of properly analyzing assets cannot be emphasized. Real estate holdings, for example, represent a large portion of a person's assets, having a substantial impact on their wealth. Investments in stocks, bonds, and other financial instruments are equally important. The value of these holdings, both tangible and intangible, varies over time, making precise estimations and computations difficult. However, a thorough grasp of assets provides essential insight into the financial scenario and enables a better comprehension of the elements impacting overall financial stability. This is true for everybody, including prominent persons.

In conclusion, assets are an important component of wealth and determine a person's financial status. The kinds and values of assets have a direct impact on overall calculation. Because the value of assets is not fixed and may fluctuate, exact calculations are difficult. Furthermore, the relative relevance of various asset classes varies from person to situation. Understanding the many asset categories and their role in calculating wealth is critical for developing a complete picture of a person's financial situation.

A person's debts and obligations are referred to as liabilities. These variables have a direct impact on wealth. A thorough grasp of liabilities is required for a complete picture of financial stability. Understanding the different kinds of liabilities, their amounts, and their possible impact on overall financial health is essential for understanding the entire significance of Justine Wilson's financial condition (or anyone's). This research examines important aspects of liabilities as well as their connection to wealth.

- Debt Obligations

Examples of debt commitments include loans, mortgages, credit card balances, and outstanding payments. These represent financial obligations to third parties. The amount of debt and interest rates connected with these responsibilities have a direct impact on wealth calculation. High levels of debt diminish wealth. For persons like Justine Wilson, the nature and extent of debt commitments may influence available resources and investment prospects.

- Tax Liabilities

Tax duties, such as income, property, and sales taxes, are a significant component of liabilities. Accurate and on-time tax payment is critical. Delays or discrepancies in tax payments may result in financial penalties and have a substantial impact on total wealth calculation. These factors are essential when evaluating financial well-being, particularly for high-income persons.

- Unforeseen Liabilities

Unforeseen events, such as legal claims or medical bills, may result in unforeseen debts. These unforeseen events may have a significant impact on financial stability and wealth. The possibility of these kinds of debts emphasizes the need of thorough financial planning and risk management. For high-profile persons such as Justine Wilson, appropriate preparation for such circumstances may greatly lessen the impact on financial stability.

- Liability Management and its Impact

Effective liability management is critical for protecting and increasing wealth. Strategies for lowering debt, controlling costs, and maximizing income all have a significant impact on a person's overall financial health. This aspect of financial management is critical to a person's overall financial well-being. Effective liability management is an important factor in maintaining and potentially increasing wealth, including for someone like Justine Wilson or a comparable topic.

In conclusion, obligations are a key component of wealth. By knowing the nature, degree, and management of various obligations, it is clear how debt responsibilities, taxes, and unforeseen events affect a person's financial situation. Effective liability management is critical for maintaining and growing wealth. This applies to everyone, including high-profile persons such as Justine Wilson, and emphasizes the overall necessity of sound financial practices.

Investment gains have a considerable impact on a person's wealth. Returns on investments, whether positive or negative, have a direct impact on overall financial condition. The magnitude and consistency of returns are critical in accumulating wealth and establishing a solid financial foundation. This holds true for people like Justine Wilson, as well as anybody with substantial assets.

Positive investment returns lead to higher wealth. Successful investment strategies that use various methods to portfolio management, such as diversification and risk assessment, may generate substantial returns. For example, clever investments in growth stocks, real estate, or other appreciating assets can significantly raise a person's overall wealth over time. Poor investment choices or market downturns, on the other hand, may result in losses, potentially lowering wealth. The link between investment returns and overall financial health emphasizes the critical importance of strategic investment choices.

Understanding the link between investment returns and wealth is essential for informed financial planning. A thorough knowledge of investment returns, as a component of a person's wealth, allows individuals to make well-informed investment choices and potentially optimize their overall financial position. Precise figures for Justine Wilson's investments and returns are not publicly accessible. However, general investment strategy concepts and their impact on wealth are relevant to anybody with investments. As a result, the necessity of prudent investment choices, knowing investment risk, and diversifying investment portfolios are all critical to financial well-being and asset growth.

Expense management is inextricably linked to a person's wealth. Effective cost control has a direct impact on wealth accumulation and protection. Careful spending planning is required to attain financial stability and long-term prosperity. Expense management concepts are applicable to people in all walks of life, including prominent public people such as Justine Wilson.

- Budgeting and Prioritization

Budgeting is a crucial component of cost management. A well-defined budget allocates resources to various requirements and priorities. This entails categorizing costs (housing, food, transportation, entertainment, and so on) and establishing limitations for each category. Prioritizing needs over wants is critical since impulsive spending may deplete financial resources. Consistent adherence to a well-structured budget is essential for building and sustaining a positive wealth. A complete budget is required for high-profile persons to handle complicated financial obligations.

- Debt Management and Reduction

Managing existing debts and actively working to lower them is an important aspect of responsible cost management. High-interest debt, such as credit card debt, may significantly impede wealth accumulation. Debt repayment tactics, such as consolidation or balance transfers, are critical. Efficient debt management enables resources to be allocated to investments and other financial objectives, hence increasing wealth.

- Saving and Investing

Saving a portion of income and investing those savings may have a substantial impact on wealth. Consistent savings, even in modest amounts, contribute to a growing financial cushion. Investment strategies, whether in stocks, bonds, or real estate, are critical for wealth creation. Smart investment choices, properly aligned with long-term financial objectives, have a beneficial impact on increasing wealth.

- Review and Adjustment

Regular evaluation and adjustment of cost management tactics are required. Financial situations fluctuate over time. Personal objectives change. A flexible and adaptive approach to cost management ensures continuous alignment with changing requirements and financial goals. Reviewing and revising the budget on a regular basis enables for adapting to unexpected events and changing circumstances.

Effective cost management is the cornerstone of creating and maintaining a solid financial foundation. Individuals may positively contribute to their overall wealth by diligently managing expenses, prioritizing financial objectives, and consistently reviewing tactics. These strategies are relevant to people of all backgrounds and incomes, including high-profile persons such as Justine Wilson, regardless of their professions or public image. Expense management is critical in maximizing financial potential.

The availability of public information has a substantial impact on understanding a person's financial condition, but it does not define it. The absence of easily accessible financial information for someone like Justine Wilson emphasizes the privacy considerations around such statistics. Public information, if accessible, may include facts from publicly filed financial records, industry journals, or reported income in related businesses, and these may contribute to broader estimates of financial standing. Such information may not reveal a precise figure, but rather provide context for evaluating the overall financial situation and is essential for understanding the various elements of financial success and influence inside a given field. Publicly accessible information on investments, partnerships, and professional achievements may all impact perceptions of financial well-being.

The limited availability of precise wealth numbers for persons such as Justine Wilson highlights the distinction between public perception and private financial realities. A lack of definitive data should not overshadow the significance of considering public information in the context of overall financial success. For example, prominent roles or participation in successful businesses may indicate a substantial financial status, even if a clear wealth number is not publicized. The lack of thorough financial disclosures frequently emphasizes a delicate balance between public image and the privacy of personal financial information.

In conclusion, public information availability serves as a valuable tool for evaluating the financial standing of a person, including high-profile figures such as Justine Wilson. While a complete picture is frequently obscured by privacy concerns, publicly accessible facts, when present, offer significant context. This context enables a deeper grasp of financial success without the need for specific, private numbers. This broader viewpoint is critical for any attempt to comprehend financial status, whether for a public figure like Justine Wilson or any person for whom detailed financial information is not readily available. Understanding the constraints of public information accessibility is essential for a thoughtful analysis of financial status without infringing on privacy rights.

This section addresses frequent questions regarding Justine Wilson's financial standing. While exact wealth statistics are often unavailable to the public, this FAQ offers context and insights into the variables impacting a person's financial situation.

Question 1: Why is Justine Wilson's net worth not readily available?

Financial privacy is a basic concern for many people. The specifics of a person's financial assets and obligations are often not public record. This is true for both high-profile and less well-known individuals. A variety of factors, including legal and personal considerations, frequently restrict the availability of precise wealth information.

Question 2: What factors contribute to an individual's net worth?

Net worth is calculated by deducting total obligations from total assets. Assets include a variety of holdings, including real estate, investments, and personal property. Liabilities represent outstanding debts and financial commitments. Income sources, investment returns, and cost management practices all have an impact on overall financial position.

Question 3: How can career choices influence net worth?

Professional choices and career routes have a considerable impact. High-paying professions and successful business ventures may generate substantial income and asset accumulation. The character and stability of employment or entrepreneurial activities have a direct impact on a person's ability to accumulate wealth.

Question 4: How do investments affect net worth?

Investment choices are critical for wealth creation and protection. Successful investment strategies may generate substantial returns, hence improving wealth. Poor investment choices or market swings, on the other hand, may result in losses and have a negative impact on a person's financial situation. The kind and management of investments influence the overall financial picture.

Question 5: What is the importance of expense management in net worth?

Expense management is essential for protecting and increasing wealth. Responsible spending and financial planning are critical components in building wealth and attaining financial security. Debt management, savings, and consistent adherence to a well-defined budget are all critical components of effective cost management. These considerations are relevant to everyone, whether they are public figures or not.

Understanding the intricacies of wealth entails recognizing that exact numbers are not always accessible. The information in this FAQ gives insights into the elements that influence a person's overall financial condition without violating privacy concerns. The concepts presented here apply to everyone, regardless of public profile or financial facts.

The absence of a readily available number does not lessen the need of understanding the variables that drive financial success and stability. The concepts of income diversification, effective cost management, strategic investment, and clever liability management are all universally applicable to people seeking financial well-being, regardless of their public profile or career path. This research emphasizes the need of sound financial practices and highlights the relationship between personal decisions, economic conditions, and overall financial success.

- Decoding The 5movie Rules Kannada Year Guide Why They Matter

- Gina Torres Relationship Inside Their Love Story Updated

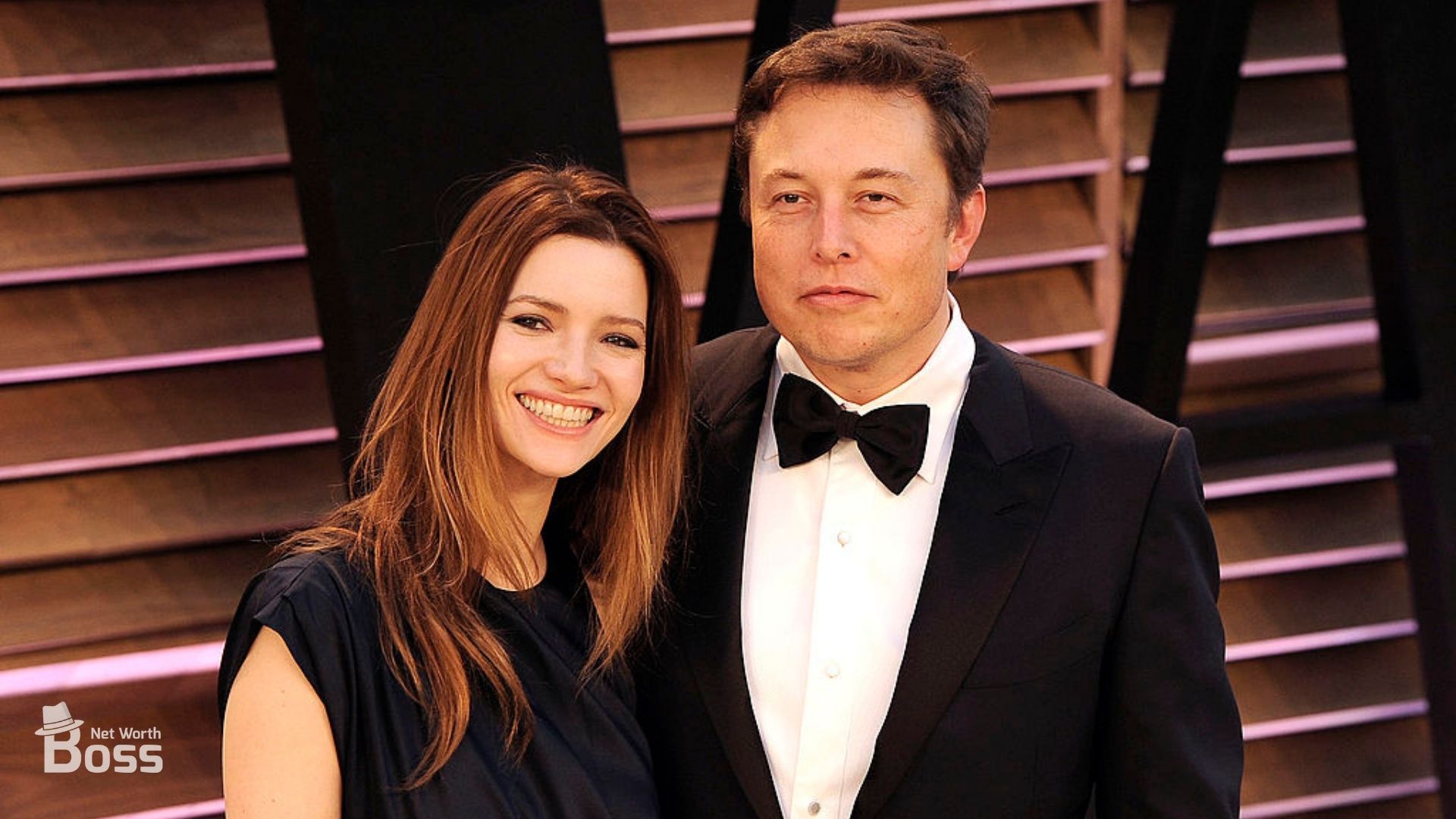

What Is Justine Wilson's Net Worth in 2023? (Elon Musk Exwife)

What Is Justine Wilson's Net Worth in 2023? (Elon Musk Exwife)

Elon Musk's First Wife Justine Musk Talks Their Messy Divorce Marie